How Much Rent Should You Charge in Ontario (2024)?

In the rapidly changing rental landscape of Ontario, the question on many landlords' minds is: "How much rent should I charge?"

According to the most recent data available, the average rent prices for Ontario are:

- Single bedroom: $1,689

- Two bedroom: $2,138

But deciding rent is more nuanced than just basing it off a provincial average (one that is also rapidly changing).

To set a rent price that both attracts renters and suits your financial goals—to strike that sweet spot—we recommend using the checklist below.

A checklist for charging the perfect rent in Ontario

Here’s an easy checklist to run through when deciding what rent to charge in Ontario:

- Calculate your financial needs

- Research local rent prices for your kind of property

- Consider projected growth

- Factor in anything that adds or detracts value

Learn more about each of these steps below.

Calculate your financial needs

There are many volatile areas of renting but one constant is your need for a positive return on investment (ROI). This is why, before anything else—looking at rent data, getting appraised, anything—calculate how much rent you need to charge to be profitable.

With this as your north star, you can rest easy knowing that, if all goes as planned, you’re at least charging what you need to make back your investment every month—and ideally more!

To calculate how much rent you need to charge to be profitable, first tally up all expenses you plan to incur in the next year, such as:

- Down payment

- Property taxes

- Utilities

- Borrowing costs

- Insurance

- Repair and maintenance

- Vacancy costs

- Any other costs you foresee

The rent you charge per month multiplied by 12 needs to amount to more than your total expense amount.

So, if you estimate your yearly expenses to be $20,000, you would need to charge $2,000 per month. At the end of the year, you’d earn $24,000 in rent or $4,000 in profit.

Research local rent prices for your kind of property

Okay, you know the bare minimum rent you need to charge. Now it’s time to look at the going rates for your area.

If you can, find government or non-profit rental data for your area, like this 2023 Greater Toronto Area Rental Market Report.

There’s also CMHC’s Rental Market Report, which provides in-depth analysis and market trends for major centres across Ontario and all other Canadian provinces. The only downside to this report is that it’s published annually so the data isn’t always current.

Another helpful resource is the Ontario Landlords Association (OLA), which is an ever-growing support group for landlords across the province.

Of course, you can also go straight to the source and look at rental prices in listings (online, in local real estate papers, real estate signs around town, etc.), such as those on Rhenti.

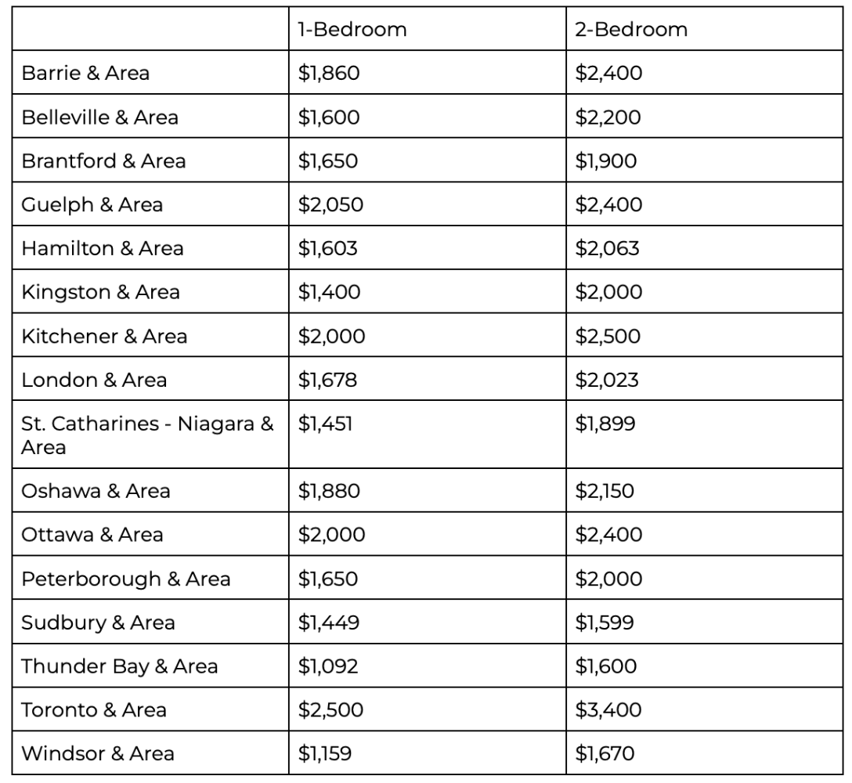

To make sure you’re working with the latest data, we encourage you to dig into these sources and do your own research. But to help get you started, here’s a look at average rent prices across Ontario*:

Consider projected growth

The right rent accounts for the current state of the rental market but also where it’s going.

Otherwise, as the market unfolds, you may find yourself stuck with a rental price that isn’t consistent with the going market rate, especially with Ontario’s rental cap of 2.5% for 2024.

For example, rents in Canada have increased by approximately $250 per month since 2019—and increased by a staggering 6.5% between March and May, 2023 alone.

To avoid leaving future money on the table, consider pricing your rent with this data (and any other projections you can find) in mind, even if that means charging higher rent initially.

Factor in anything that adds or detracts value

The final thing to factor into your rent pricing is your property itself; more specifically, things that either add or detract value.

Valuable features that might allow you to charge higher rent include:

- Renovations

- Option for units to be furnished

- Move-in incentives (free wifi and cable for a year, discounts on local businesses, free first month of rent, etc.)

- Amenities (gym, pool, etc.)

- Up-and-coming area

- Lots of natural light

- Security system

- Easy, digital application and payment system

These are just some ideas; what’s considered valuable can differ wildly depending on the property, area, and tenant.

More simply, consider if you offer anything beyond what’s necessary that improves the quality of your tenants’ lives—ideally, things that other rental properties around you don’t. These are your value-adding features and will help you attract renters.

On the other hand, consider features that might drop the value of your rental property. These might be:

- Bad location

- Small square footage

- In need of repairs or renovations

- Inaccessible

- Lack of natural light

- Lack of amenities

Is there anything that, if included in your listing, would make a potential tenant click away from your property? These are the types of things that could negatively affect your pricing.

An easier way to sign tenants at the right price

Following these steps, we hope you’re able to more easily and competitively price your rental property, no matter where you are in the province.

For more help signing tenants quickly—and at the price your property deserves—sign up for Rhenti's industry-leading software today.